We also provide legal service for your selected property.

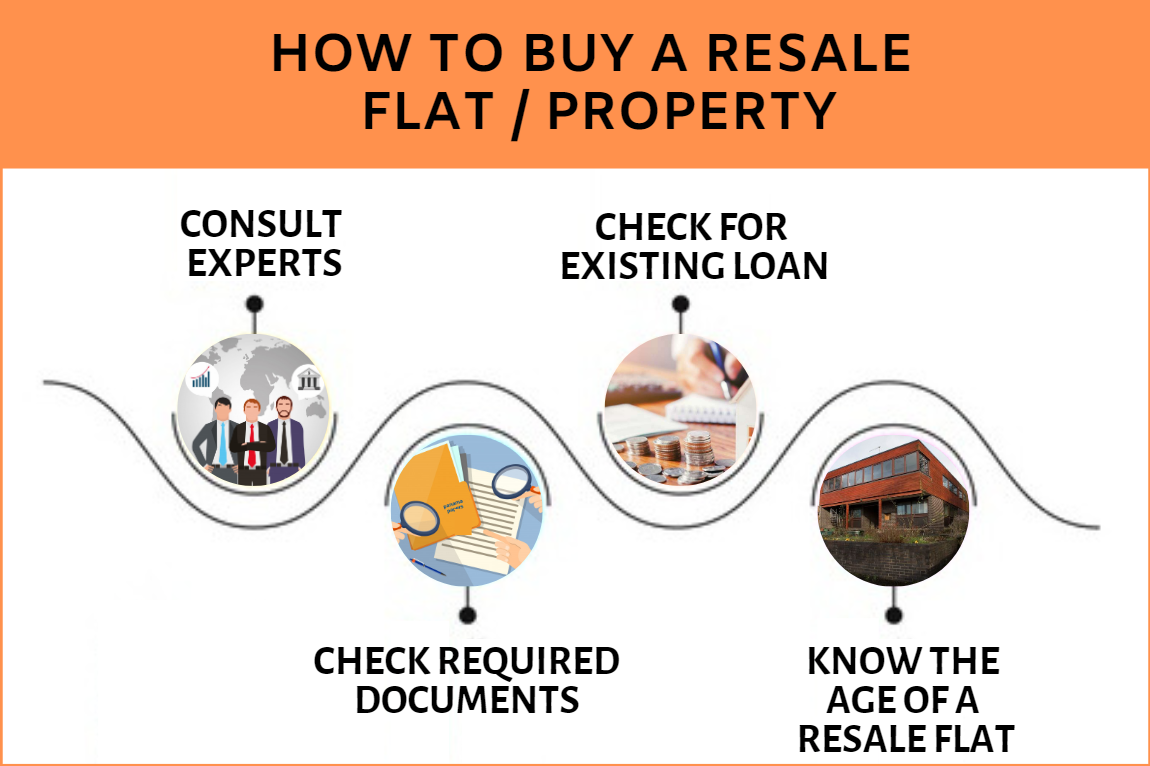

It may be ideal to engage a good real estate agent to locate a resale property/flat. He would be in a position to locate sellers as well as guide you regarding the price of such properties in different localities. They would also be in a position to tell you about the seller of the property. Most real estate agents charge a fee and also help with registration, payment of stamp duty and other paperwork procedures for purchase for buying a resale flat/property. In addition, taking the help of a good lawyer would also help to make sure that things are clear legally also.

Engaging with experts like real estate agents and lawyers will help you, but it is always better to be well-informed yourself when entering into deals and procedures for buying resale flat/property. The first step in buying a resale flat/property would be to establish the title of the seller; whether he is the real owner of the property/flat or has been given the power of attorney to transact the deal. All the documents with regard to the resale property/flat need to be clear. In addition, you need to make sure that all the original documents with regard to the resale property that were given by the builder or original developer are in order.

Buying resale property may seem great, but it could become a big problem if the documents regarding the original purchase and subsequent transfer of title are not properly stamped. Firstly, it could pose great problems especially if you want to apply for a loan for purchase of the resale property. Subsequently, it could prove to be unacceptable in case you wish to transact further on the property.

It is also necessary to make sure that the property documents are not lying mortgaged in the bank’s custody against a loan taken by the seller. The bank will consider a loan only once the loan taken by the seller is repaid and the documents released.

Buying a resale property would definitely provide you with a bigger space in case of older properties. However, it is best to note that some banks may not lend money on buildings older than 10 years. This may be due to the reason that they may not want to take the risk of the price of the property going down. Banks also make sure to ensure that the bank’s outstanding loan should always be lower than the value of the property in the market.

Next, it is imperative to note that the loan amount is highly dependent on the cost of the property. Technical experts would evaluate the property/flat. However, it would be useful to avail the services of a property valuator at a small fee before approaching the banks. The bank’s property valuator may valuate the property at a much lower rate. They would also like to safeguard their interests against the fall in the price of the property in future.

Most banks wish to make sure that you be responsible for the maintenance and good upkeep of buying the resale property/flat. So banks would expect you as the purchaser of the resale property to pay a certain percentage of the price as down payment. You may have to pay about 20% of the price as down payment; for example; property of 50 lakhs requires 10 lakh as the down payment.

This down payment could be more in case of older properties. In addition, banks usually lend only on properties that are unto 50 years old. The tenure of the loan also decreases with the age of the property.

The bank may grant the loan and you may make the down payment, but there could be another problem. It arises out of the need for some Flat societies that require the payment of a heavy price for change of ownership. It is best to consider this cost also when coming to a conclusion while purchasing resale property in cooperative and other societies.

Legal Process for Buying a Flat in From Builder/ New Construction

The process of buying a house in India is possibly one of the biggest personal investments and tedious processes. Living in a self-owned abode is a dream aspiration for millions in India. As home-buying is once in a lifetime event, it also has the homebuyers' emotions deeply attached to the experience from day one.

At the outset, any set of tips for buying a flat says that one needs to fix a budget, location and requirements as per personal or family needs. However, beyond that when it comes down to making the final decision, we enter the world of the legal process of buying a house in India.

While some people have peripheral knowledge of the legalities involved in this process, others are confused and worried. Home buyers are often misguided by ill-informed brokers or shady builders, resulting in loss of money and other legal risks.

To help you understand the process of buying a home in India here’s the breakage of essentials into simpler steps. It is like a property buying guide – except it covers the legal aspects and not the general ones.